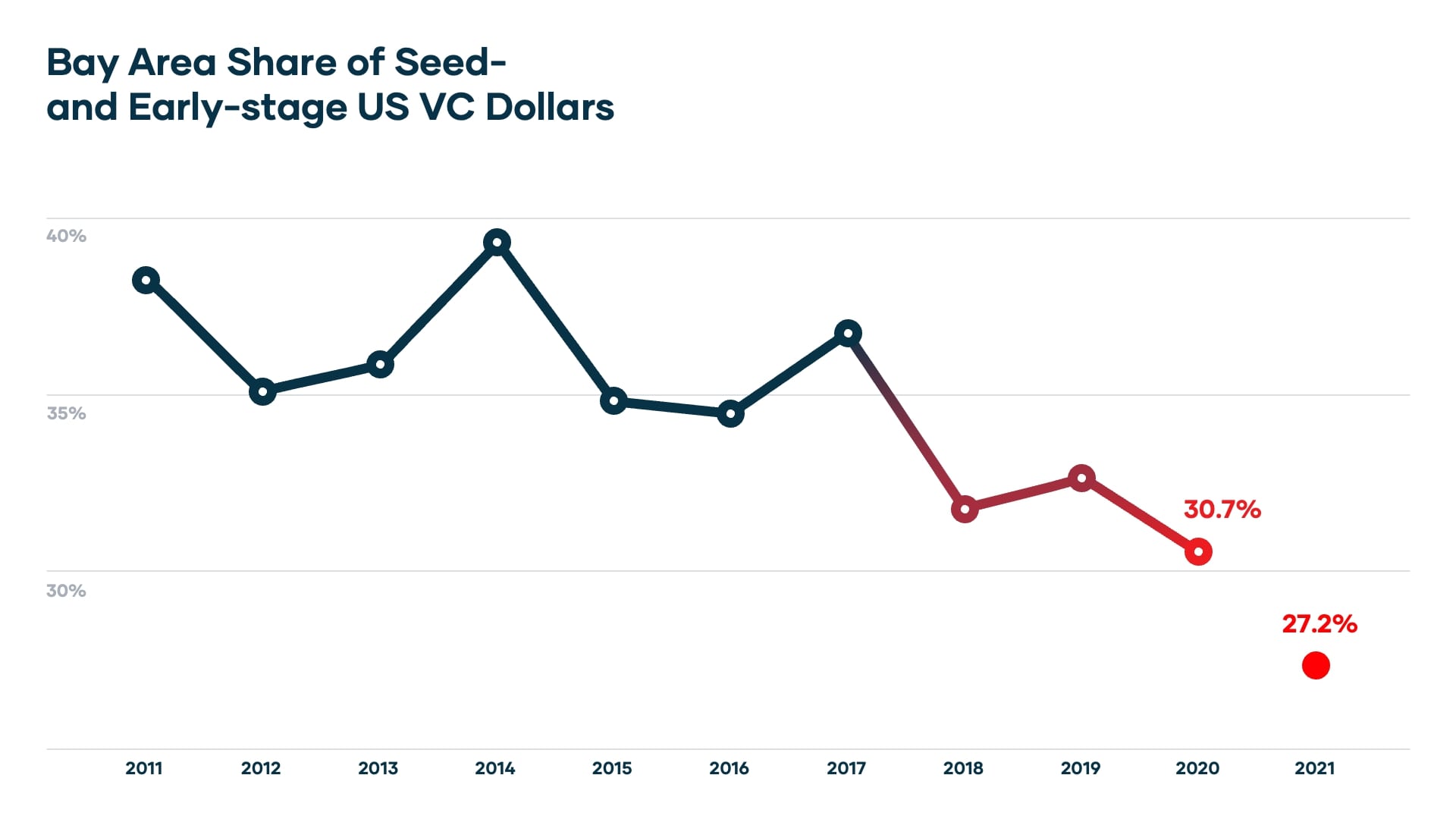

2021 was a record year for venture, but where did those dollars go? Not where you might expect. For the first time in more than a decade, the proportion of seed- and early-stage capital invested in Bay Area Startups fell below 30%.

Having visited, backed, and spotlighted companies in rising startup ecosystems for the last decade, Revolution’s Rise of the Rest Seed Fund partnered with PitchBook to take a closer look at this seismic shift. The full report explores how the trend towards investing in rising cities evolved, including notable pandemic-related accelerations, with highlights including:

-

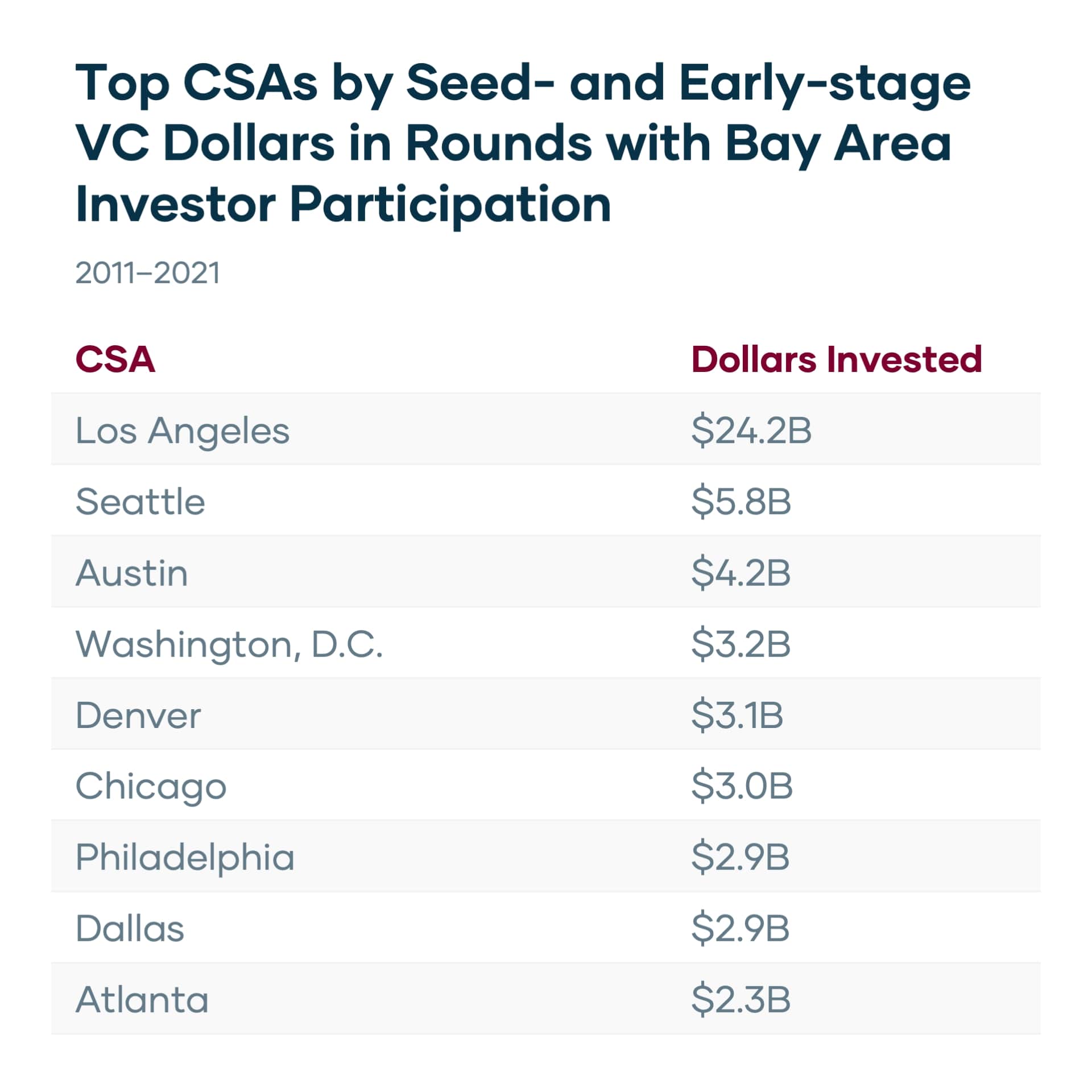

Cities attracting the most seed- and early-stage capital from Bay Area- and NYC-based investors;

-

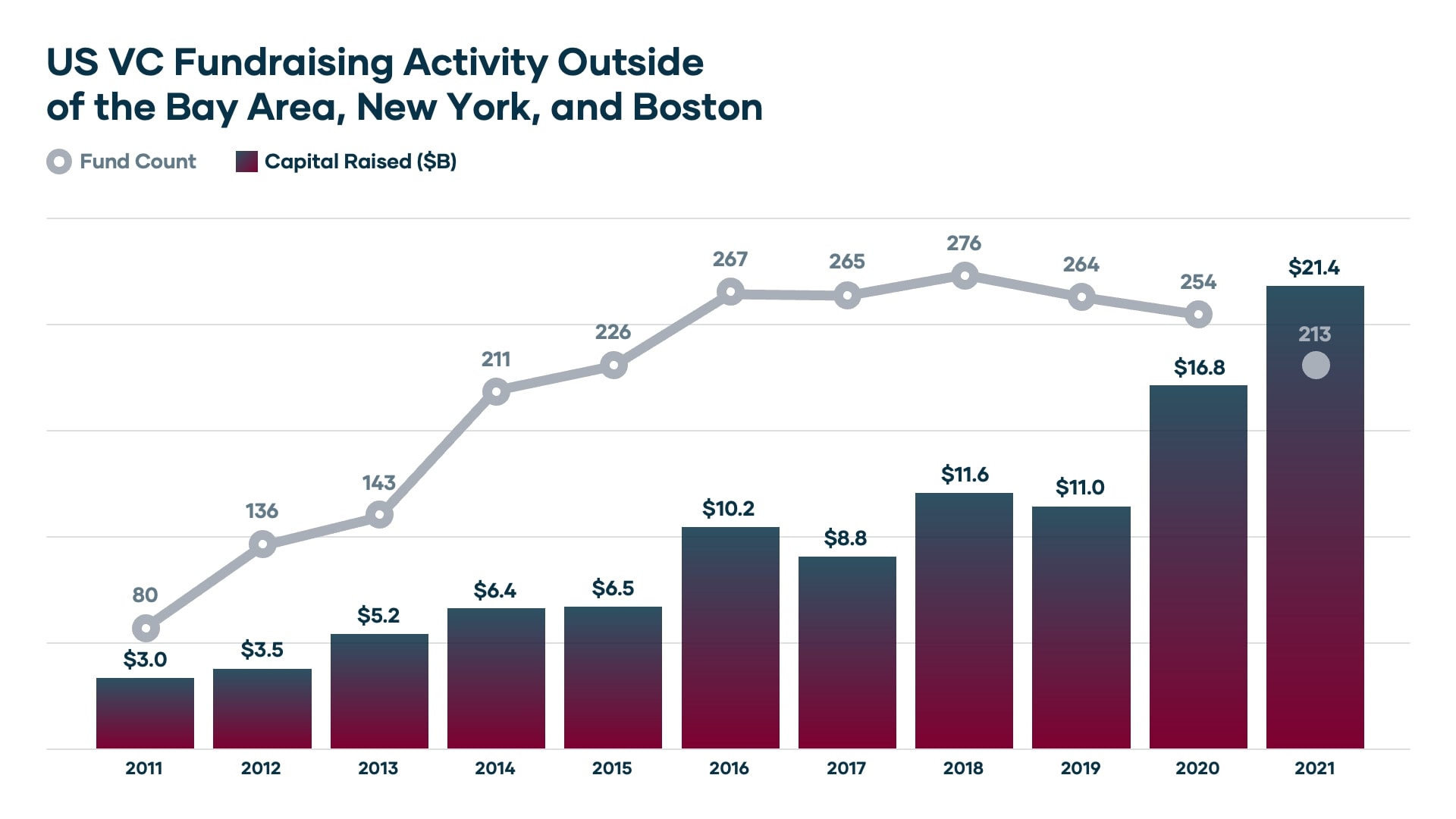

The impact of an increasing number of regional venture investors;

- Insights from local partners in rising startup ecosystems.

“Salt Lake City is already punching way above its weight – in a lot of ways, Utah today is like the Bay Area in the late 1990s.”

While the findings from the report are validating, the pieces of this puzzle are complex. Getting innovation off the ground isn’t about following a Silicon Valley recipe. That’s why Revolution has spent years building our nationwide network, meeting founders where they are. We don’t see this as just investing in companies. We are investing in entrepreneurial communities.

Talent is equally distributed, but opportunity is not. We hope that the acceleration of capital away from the Silicon Valley isn’t just a pandemic blip on the radar, but a turning point for entrepreneurs everywhere, and a final blow to the idea that the Bay Area has a monopoly on US innovation. Find more evidence for this thesis and insights on rising startup communities in Beyond Silicon Valley.